Harvey Jones secures landmark investment following sale

Harvey Jones secures landmark investment following sale

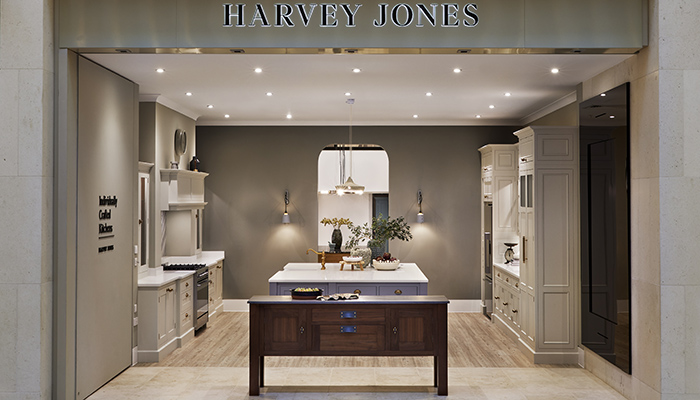

High-end kitchen maker Harvey Jones has announced new ownership and investment from an institutional investor.

The company says the new investment will accelerate the strategic transformation of the Harvey Jones business in 2024, with further product and omnichannel development in the premium kitchen space as well as optimising reach for additional areas in the home.

In an announcement to the press, the company added the investor will work closely with the management team at Harvey Jones to support the development of the brand.

Vince Gunn, Harvey Jones CEO, said: “We are delighted to be working with our new owners and investors who will provide us with the support and expertise to accelerate our business transformation and realise the profound potential that underpins the much loved Harvey Jones brand.”

The acquisition of Harvey Jones by a fund managed by RBC BlueBay Asset Management was facilitated by way of a pre-pack administration. Chris Pole and Ryan Grant from the financial advisory firm Interpath were appointed joint administrators of Harvey Jones Limited on 23 February 2024. Immediately following their appointment, they concluded a sale of the business and its assets to the fund.

All of the 140 employees have transferred to the purchaser as part of the transaction.

Chris Pole, managing director of Interpath Advisory and joint administrator, said: “With a proud heritage stretching back over 45 years, Harvey Jones has forged a strong reputation for the quality of its designs and craftsmanship. We are pleased to have been able to secure this transaction which will provide the business with a stable financial platform upon which it can move forward. We wish the management team and the new owners all the best for the future."

Tags: kitchens, news, harvey jones