Buying groups offer many benefits when times are tough, says MHK-UK

Buying groups offer many benefits when times are tough, says MHK-UK

MHK-UK, part of Europe’s kitchen buying and business support group MHK, says that as inflation, energy costs and product shortages continue to increase, a higher degree of stability and security, both for suppliers and retailers, is offered in the form of their buying and business support group.

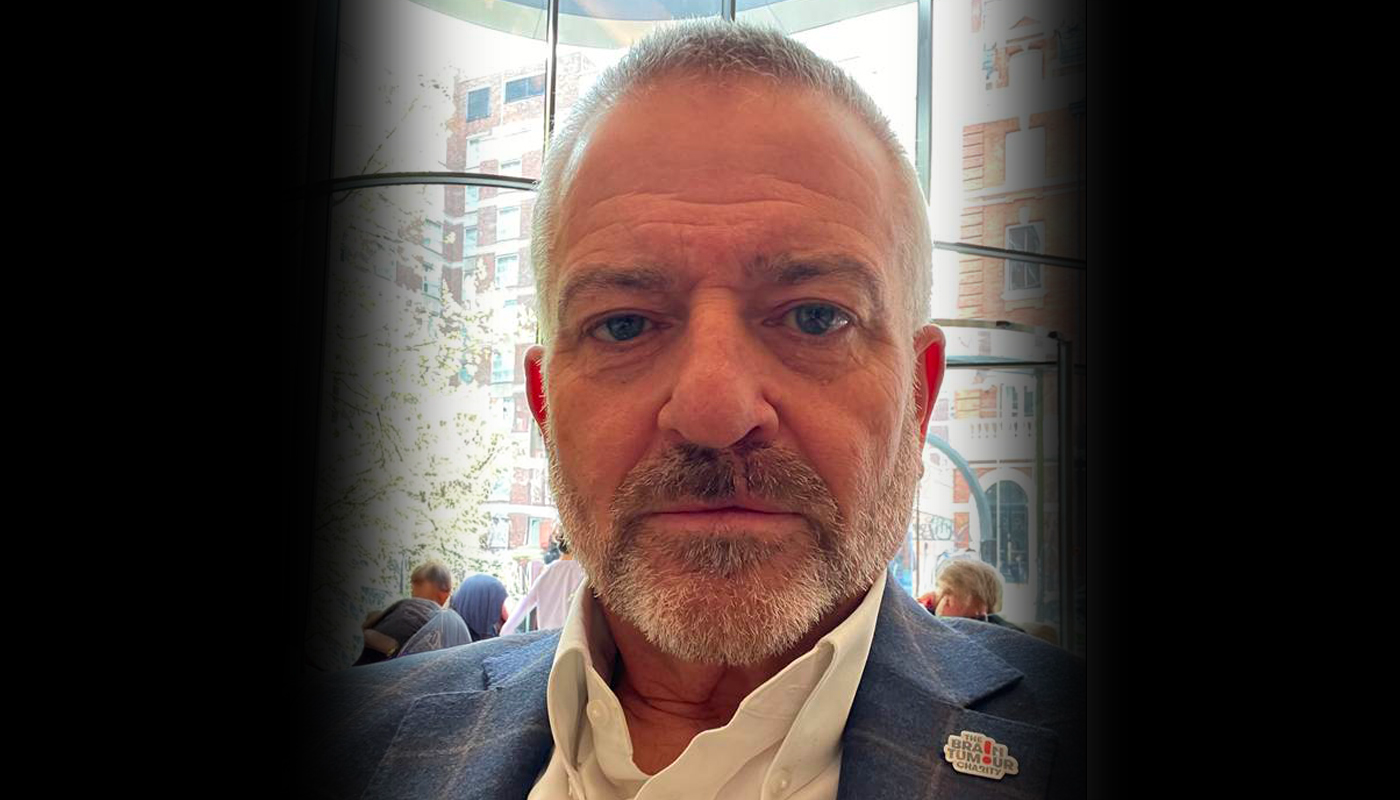

David Morris, UK sales manager for MHK-UK, said: "Whilst we believe that demand for kitchens will remain strong – throughout 2022, increasing energy costs and a shortage of materials and key components is bound to impact on manufacturers and ultimately those retailers not in a buying group.

"Furthermore, whilst inflation and demand will continue to see UK property values rise, the impact of inflation on manufacturers and the need for them to increase trade prices, due to increased energy and material costs, could impact harder on the lower to mid market kitchen sectors. This further endorses the effectiveness and appeal of MHK-UK to both the manufacturer/supplier and the independent retailer.”

According to Morris, manufacturers fighting increased energy costs and possibly an uncertain future can be better supported by MHK-UK’s ready retail membership audience, while benefitting from guaranteed 30 day payments direct from MHK.

He believes the appeal of MHK-UK to the independent kitchen retailer comes in a number of ways. The size of MHK means that MHK-UK retailers benefit from a more ready supply of both kitchen furniture and appliance products. The volume, which MHK is able to offer manufacturers and suppliers, means that MHK-UK retailers benefit from much improved margins and this, to a great extent, offsets any price increases from manufacturers and suppliers.

Morris adds that MHK-UK’s extended retailer credit terms mean that, not only is cash-flow eased, but also the size of the deposit required from the retail customer can be greatly reduced. In addition, loyalty/sales bonuses that are awarded each year to MHK-UK retailers, can run into five or six figures, offering the ability to strengthen their business model and placing them in a better position to tackle unforeseen market conditions.

Tags: industry, news, mhk-uk, david morris, buying groups